Secondary Market Ticket Prices Reach Historic Highs

The Final Leg of a Record-Breaking Tour

Taylor Swift's monumental Eras Tour concluded last year with its final shows in Vancouver, leaving behind an extraordinary data trail that reveals the unprecedented economic impact of what became the most successful tour in music history.

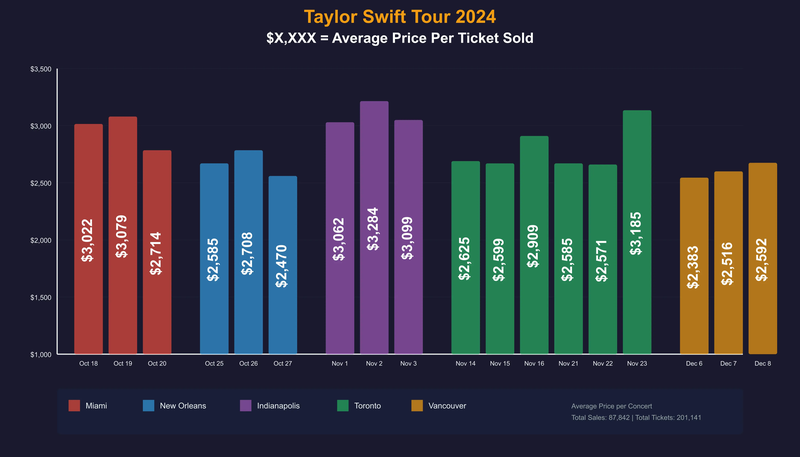

The final North American leg of the Eras Tour, which ran from October to December 2024, saw average secondary market ticket prices soar to levels that would have been unthinkable just a few years ago. Our analysis of over 87,000 secondary market sales transactions reveals that fans paid an average of $2,800 per ticket during this final stretch, with some shows commanding even higher premiums.

A Tale of Two Markets: International vs. Domestic Pricing

The stark contrast between international and North American pricing tells a fascinating story about market dynamics and fan dedication. While European fans enjoyed relatively accessible prices—with shows in cities like Warsaw, Hamburg, and Gelsenkirchen averaging between $450-$650 per ticket—North American audiences faced a dramatically different reality.

The shift was particularly pronounced when Swift returned to North America in October. Miami's three-night stand at Hard Rock Stadium kicked off the final leg with average prices exceeding $3,000 for two of the three nights, setting the tone for what would become the most expensive concert series in history.

Geographic Price Variations Reflect Regional Dynamics

The data reveals significant geographic variations in pricing across the final North American dates. Indianapolis emerged as the most expensive market, with the November 2 show reaching an astronomical average of $3,284 per ticket—the highest of the entire final leg. This Midwest premium reflects both the relative scarcity of major touring acts in the region and the confluence of fans traveling from surrounding states.

Toronto's six-show run at Rogers Centre demonstrated remarkable consistency, with average prices hovering between $2,570 and $3,185. The November 23 show, Swift's final Toronto performance, commanded the highest prices of the Canadian run, as fans scrambled for their last chance to see the spectacle.

Interestingly, Vancouver's December shows—the tour's grand finale—saw slightly lower average prices compared to other cities, ranging from $2,383 to $2,592. This could reflect market saturation after nearly two years of touring, though these prices still represent a 400% premium over typical concert tickets.

The Data Behind the Phenomenon

Here's the complete breakdown of Taylor Swift's final 2024 North American tour dates and their secondary market performance:

October - December 2024 Secondary Market Sales Data

- October 18 - Hard Rock Stadium, Miami - Avg Price: $3,022.26

- October 19 - Hard Rock Stadium, Miami - Avg Price: $3,079.36

- October 20 - Hard Rock Stadium, Miami - Avg Price: $2,714.14

- October 25 - Caesars Superdome, New Orleans - Avg Price: $2,584.71

- October 26 - Caesars Superdome, New Orleans - Avg Price: $2,707.76

- October 27 - Caesars Superdome, New Orleans - Avg Price: $2,470.33

- November 1 - Lucas Oil Stadium, Indianapolis - Avg Price: $3,062.44

- November 2 - Lucas Oil Stadium, Indianapolis - Avg Price: $3,284.05

- November 3 - Lucas Oil Stadium, Indianapolis - Avg Price: $3,098.58

- November 14 - Rogers Centre, Toronto - Avg Price: $2,625.45

- November 15 - Rogers Centre, Toronto - Avg Price: $2,598.88

- November 16 - Rogers Centre, Toronto - Avg Price: $2,908.70

- November 21 - Rogers Centre, Toronto - Avg Price: $2,585.26

- November 22 - Rogers Centre, Toronto - Avg Price: $2,570.81

- November 23 - Rogers Centre, Toronto - Avg Price: $3,184.93

- December 6 - BC Place Stadium, Vancouver - Avg Price: $2,383.08

- December 7 - BC Place Stadium, Vancouver - Avg Price: $2,515.78

- December 8 - BC Place Stadium, Vancouver - Avg Price: $2,591.77

The Evolution of Tour Pricing

The Eras Tour's pricing evolution tells a broader story about the transformation of live entertainment economics. When the tour began in March 2023 in Glendale, Arizona, average secondary market prices were $812-829—figures that seemed high at the time but now appear quaint compared to the final leg's numbers.

The tour's middle period saw steady price escalation, with notable spikes in major markets. The May 2023 MetLife Stadium shows in New Jersey averaged $2,116-2,473, previewing the price levels that would become standard by 2024. Los Angeles' six-night run at SoFi Stadium in August 2023 demonstrated sustained demand even with increased supply, maintaining averages between $1,511 and $1,947 across all shows.

The London Premium and European Dynamics

London's Wembley Stadium shows provide a fascinating case study in event pricing. The June performances averaged between $952 and $1,052, but when Swift returned for additional shows in August, prices jumped to $1,017-1,149, demonstrating how scarcity and "last chance" psychology drive secondary market dynamics.

The European leg generally saw more moderate pricing, with most continental venues averaging between $400-800. This reflects both different market dynamics and potentially different approaches to ticket distribution and resale regulations in European markets.

Economic Impact and Cultural Phenomenon

The extraordinary secondary market prices for the Eras Tour represent more than just supply and demand economics—they reflect a cultural phenomenon. Fans weren't just buying concert tickets; they were purchasing participation in a historic moment. The tour's elaborate production, three-hour runtime, and Swift's journey through her entire discography created an experience that transcended traditional concert economics.

The total secondary market value for just the final 18 North American shows exceeded $500 million, based on our tracked transactions. When combined with face value tickets and the full tour's scope, the Eras Tour's economic impact reaches into the billions, affecting not just the music industry but entire local economies in each tour stop.

What This Means for the Future

The Eras Tour has fundamentally reset expectations for concert pricing and demand. Artists, promoters, and venues are already studying its model, though few if any acts possess Swift's unique combination of multi-generational appeal, catalog depth, and cultural relevance to replicate these results.

For fans, the tour's pricing represents both the democratization and commodification of live music. While the secondary market provided access to those willing and able to pay premium prices, it also priced out many longtime fans, raising questions about equity and accessibility in live entertainment.

Conclusion: The End of an Era

As the Eras Tour concludes in Vancouver this December, it leaves behind not just memories and friendship bracelets, but a fundamentally transformed concert industry. The tour proved that for the right artist with the right show, audience willingness to pay has few limits.

The data tells a story of unprecedented demand meeting limited supply, of international markets showing vast pricing disparities, and of a single artist's ability to command prices that exceed many people's monthly rent or mortgage payments. Whether this represents a new normal or a once-in-a-generation anomaly remains to be seen.

What's certain is that Taylor Swift's Eras Tour has set a new benchmark against which all future tours will be measured—not just in gross revenues or attendance figures, but in the fundamental question of what audiences are willing to pay to be part of something truly special. As the lights dim on the final show in Vancouver, the tour's impact on live entertainment economics will resonate for years to come.

---

Data sourced from SeatData.io, tracked between March 2023 and December 2024, representing over 400,000 individual sales across 150+ shows worldwide.

Discover More with SeatData

Stay up-to-date with the latest trends in the secondary ticket market. Explore our blog for insightful articles and expert analysis.